What Does Triple Peaks Mean in Trading? Mastering the Triple Top Pattern

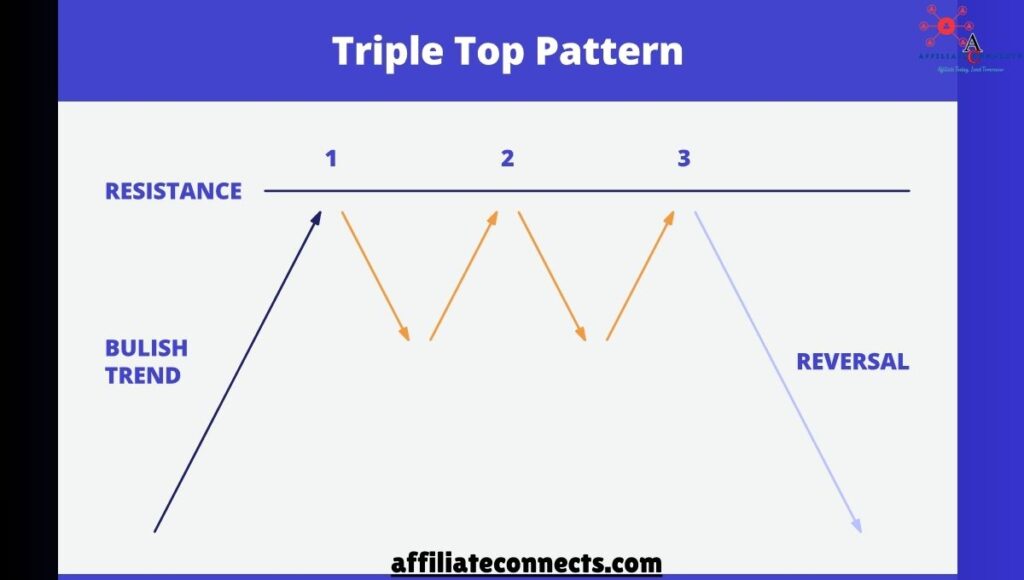

The term “triple peaks” in buying and selling refers to a particular chart pattern that is a part of technical analysis known as the “triple top.” This sample is a bearish reversal indicator which can assist investors perceive whilst the fee of an asset is set to experience a massive downward trend. Understanding What Does Triple Peaks Mean in Trading? Suggesting in trading is essential for every person interested in predicting capacity reversals inside the market.

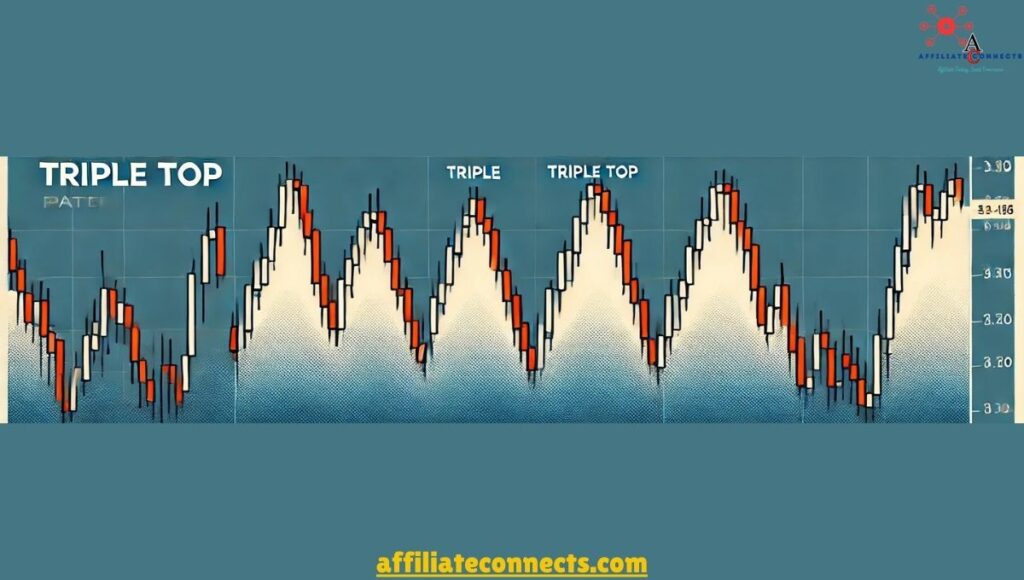

The triple top sample happens when an asset’s charge reaches the identical resistance level 3 instances, with each peak observed with the aid of a pullback or decline. The sample is whole when the fee breaks beneath a key guide level shaped via the troughs between the peaks. Traders who spot this pattern can put together to take action by using getting into quick positions, looking forward to the charge will fall after the third top.

In this article, What Does Triple Peaks Mean in Trading? We can discover the formation of the triple top pattern. It is important to know how to identify it on a chart. There are effective strategies for buying and selling it. We will also cover its limitations. Using the triple top pattern with other technical indicators helps reduce risk.

Understanding the triple top pattern can improve your trading strategy. It helps identify bearish reversal signals. Learning to spot and trade it is essential.

Formation of the Triple Top Pattern

The formation of the triple top pattern goes through four distinct stages. Each stage is crucial in the pattern’s development.Understanding this sequence is essential.It helps in identifying the pattern in real-time charts. The following outlines each degree:

First Peak: The price rises to a resistance level and starts to drag back after hitting this resistance.

Second Peak: The price makes a 2d try to breach the resistance degree, however it fails and declines again.

Third Peak: They make a final strive to break through the resistance, but again, the attempt fails, and the price starts to fall.

Breakdown: The price breaks under the help degree shaped by way of the troughs between the peaks. This confirms the sample and indicators an ability reversal to the downside.

Investors can make informed decisions after seeing the sample. They can determine when to enter the market. They can also decide where to set stop-loss orders. This structure signals a shift in momentum. It shows a change from shoppers to sellers. This is important for traders aiming to profit from price declines.

Identifying the Triple Top Pattern

In order to accurately perceive the triple pinnacle sample, numerous key traits should be gift:

Three peaks at roughly the equal charge degree: This suggests that the resistance level is robust and that fee is suffering to interrupt thru.

Two intervening troughs: These troughs form the assist degree and create the bottom among the peaks.

A previous uptrend: The triple pinnacle sample bureaucracy after a strong uptrend, displaying that the asset has been rising before encountering resistance.

A next breakdown: This is the final confirmation that the price will fall after the 0.33 top, because it breaks beneath the hooked up support.

Trading the Triple Top Pattern

When you identify a triple pinnacle pattern, you can take several steps to trade it efficiently.

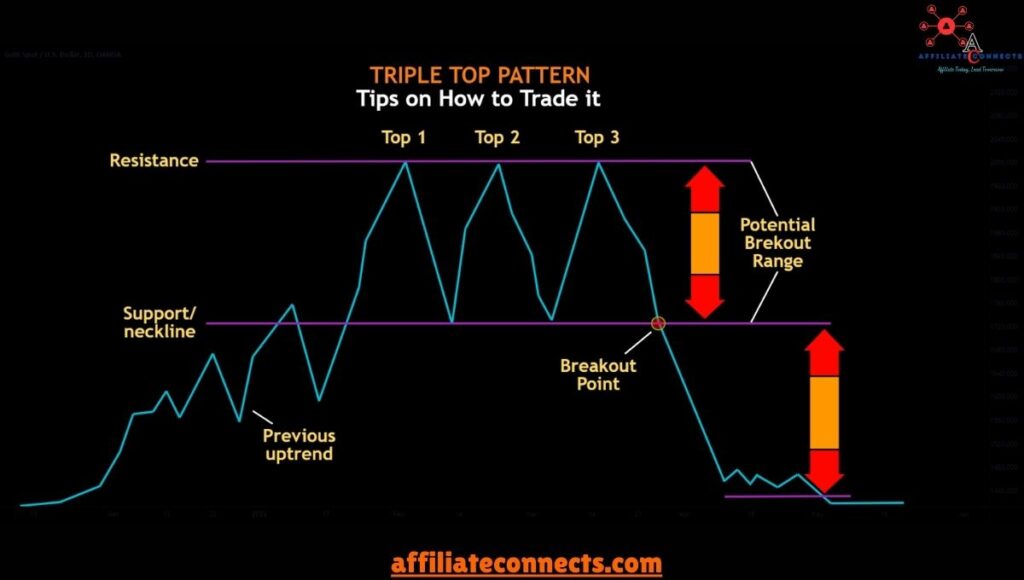

Entry Point: Enter a quick position whilst the rate breaks below the guide degree formed through the troughs between the peaks. This confirms that the asset’s rate is probable to retain downward.

Stop-Loss Placement: Always region a stop-loss order above the resistance stage to defend yourself from sudden charge moves. This guarantees that if the charge does not fall as predicted, you will have restricted losses.

Profit Target: The best income goal can be calculated by measuring the distance between the resistance level and the aid stage. Subtract that distance from the breakout point to determine in which the charge might cross after the breakdown.

By the usage of those techniques, investors can create a chance-controlled approach to trading the triple top pattern.

Triple Top vs. Head and Shoulders Pattern

It’s additionally crucial to distinguish the triple pinnacle pattern from other bearish reversal patterns, mainly the head and shoulders sample. Both signal an ability decline in fee, but they vary in shape:

Triple Top: The sample includes three peaks that occur at more or less the identical charge level, with equal resistance.

Head and Shoulders: This sample entails 3 peaks, however the middle top (head) is better than the 2 side peaks (shoulders). This shape is extra distinct in its sign of a reversal.

Understanding the variations among those styles allows traders to make greater specific predictions about price actions.

Limitations of the Triple Top Pattern

While the triple pinnacle sample is a reliable indicator, it does have some boundaries that buyers want to be privy to:

False Signals: The pattern can fail, main to wrong predictions. Sometimes, the price might ruin the resistance degree briefly but then resume the upward fashion, invalidating the pattern.

Time Frame: The triple pinnacle sample typically forms over weeks or months, which might not be appropriate for short-time period traders or the ones looking for quicker trades.

Volume Confirmation: A loss of elevated quantity during the breakdown of the help stage can signal that the sample isn’t as robust, reducing the reliability of the trade.

Best Time Frame for Trading Triple Top

While the What Does Triple Peaks Mean in Trading? sample may be discovered in diverse time frames, it is simplest on better time frames, inclusive of daily and weekly charts. These time frames offer greater reliable signals, as they display a clearer marketplace trend. In comparison, smaller time frames like 1-hour or 15-minute charts can produce false indicators due to marketplace noise.

For lengthy-time period investors, it’s miles really helpful to consciousness on every day or weekly charts for an extra accurate identity of the sample. For day traders or swing buyers, it’s better to look for affirmation on both shorter and longer time frames to ensure the sample’s reliability.

Example: Real-World Application of the Triple Top Pattern

Consider a scenario where the fee of an inventory has been growing step by step for numerous months, only to stumble upon resistance at a specific price degree. The price attempts to break above that degree three instances, however every time, it falls back. After the 1/3 height, the price breaks underneath the guide stage, confirming the pattern. A trader could then input a short position, with a forestall-loss positioned simply above the resistance stage, and set an earnings target primarily based on the measured distance among the resistance and assist.

This example indicates how the triple top sample can be efficaciously used to be expecting rate declines, however also highlights the want for careful chance control, as the pattern isn’t constantly foolproof.

Conclusion: What Does Triple Peaks Mean in Trading?

In conclusion, understanding What Does Triple Peaks Mean in Trading? can greatly enhance your ability to be expecting fee moves. The triple pinnacle pattern is a precious device for figuring out capacity bearish reversals, specifically while confirmed by a breakdown of the aid level. However, it is not foolproof, and traders must be careful of false signals and the limitations of the sample.

By the usage of right threat control techniques along with prevent-loss orders, and confirming the pattern with other signs, traders can improve their chances of fulfillment when trading this chart pattern. Furthermore, it’s essential to remember the timeframe, as the triple top generally forms over longer periods.

Additional Tips: What Does Triple Peaks Mean in Trading?

Use Additional Indicators: Combine the triple top pattern with different technical indicators, consisting of moving averages, RSI, or MACD, to verify the capacity reversal.

Be Patient: The triple pinnacle pattern takes time to form, and traders must keep away from jumping into trades upfront.

Stay Updated: Keep an eye on broader market developments, as a strong uptrend or downtrend in the typical marketplace can have an impact on the effectiveness of the sample.

Understand Volume Dynamics: Look for increasing volume all through the breakdown for stronger confirmation of the sample.

By thinking about those extra recommendations, investors could make more informed selections and minimize hazard.

FAQs of What Does Triple Peaks Mean in Trading?

What does triple peaks imply in trading?

The triple peaks consult with the triple top sample, a bearish reversal indicator in which the fee reaches an excessive 3 instances earlier than declining.

How do I perceive a triple top sample?

Look for 3 peaks at similar levels, with two troughs among them, and a breakdown below the assist stage.

What does extent indicate while confirming the triple top pattern?

A growth in volume during the breakdown adds credibility to the pattern, confirming that the reversal is probably to occur.

How does the triple top fluctuate from head and shoulders?

The triple top has 3 peaks of same peak, whilst the pinnacle and shoulders pattern has a higher center top.

Can the triple pinnacle sample fail?

Yes, it is able to on occasion supply fake alerts, in particular if there may be no good sized boom in extent in the course of the breakdown.

How long does it take for a triple pinnacle to shape?

The sample generally takes weeks or months to form, making it more suitable for lengthy-term traders.

What is the first-class approach for buying and selling a triple pinnacle?

Enter a short role after the rate breaks below the assist degree, set a stop-loss above resistance, and decide the earnings target based on the pattern’s peak.

Should I use other signs with the triple pinnacle pattern?

Yes, combining it with indicators like RSI or MACD facilitates confirm the sign and reduce danger.

Is the triple pinnacle sample useful in all markets?

Yes, it may be applied to shares, foreign exchange, commodities, and other markets.

What takes place if the price does not destroy beneath the help stage after the 1/3 peak?

If the fee doesn’t break the help, the sample isn’t always confirmed, and the price would possibly continue to rise.

Read more about Business and other categories on AffiliateConnects

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my trouble You are amazing Thanks

Thank You for the Recommendation

Thank you for your kind words—I’m so glad you found the information helpful! And please thank your cousin for recommending this resource to you; it’s always wonderful to hear that our work makes a difference.

If there’s anything else I can assist you with, or if you’d like further clarification, don’t hesitate to reach out. I’m happy to help!

Best regards,